What happens to internet accounts when you die?

Internet accounts are becoming an increasingly important part of our lives – but what happens to them afterwards? We will show you which precautions you can take with the ‘digital estate’ in order to handle it as smoothly as a ‘classic’ inheritance.

How testamentary capacity is assessed in people with dementia

Dementia is a disease that affects a person’s mental state. In advanced stages, those suffering from dementia may lose their capacity of judgement. This impacts the possible actions available during their lifetime and when managing their estate.

Progression of dementia

Dementia is usually a chronic disease in which the mental abilities of those affected decline over time. In order to avoid difficulties in everyday life and problems during estate planning, it is important to be well prepared.

What is dementia and how do I deal with it?

Dementia is a difficult disease to deal with, both for the patient and their relatives. Therefore, it is important to recognise the signs early on. This allows you to take effective preventative measures and plan ahead.

The death certificate – certification of death

The death certificate confirms the death of a person with all important details. It is a prerequisite for important legal steps to be taken after a death. With it, the heirs can, for example, apply for the certificate of inheritance and organise the funeral.

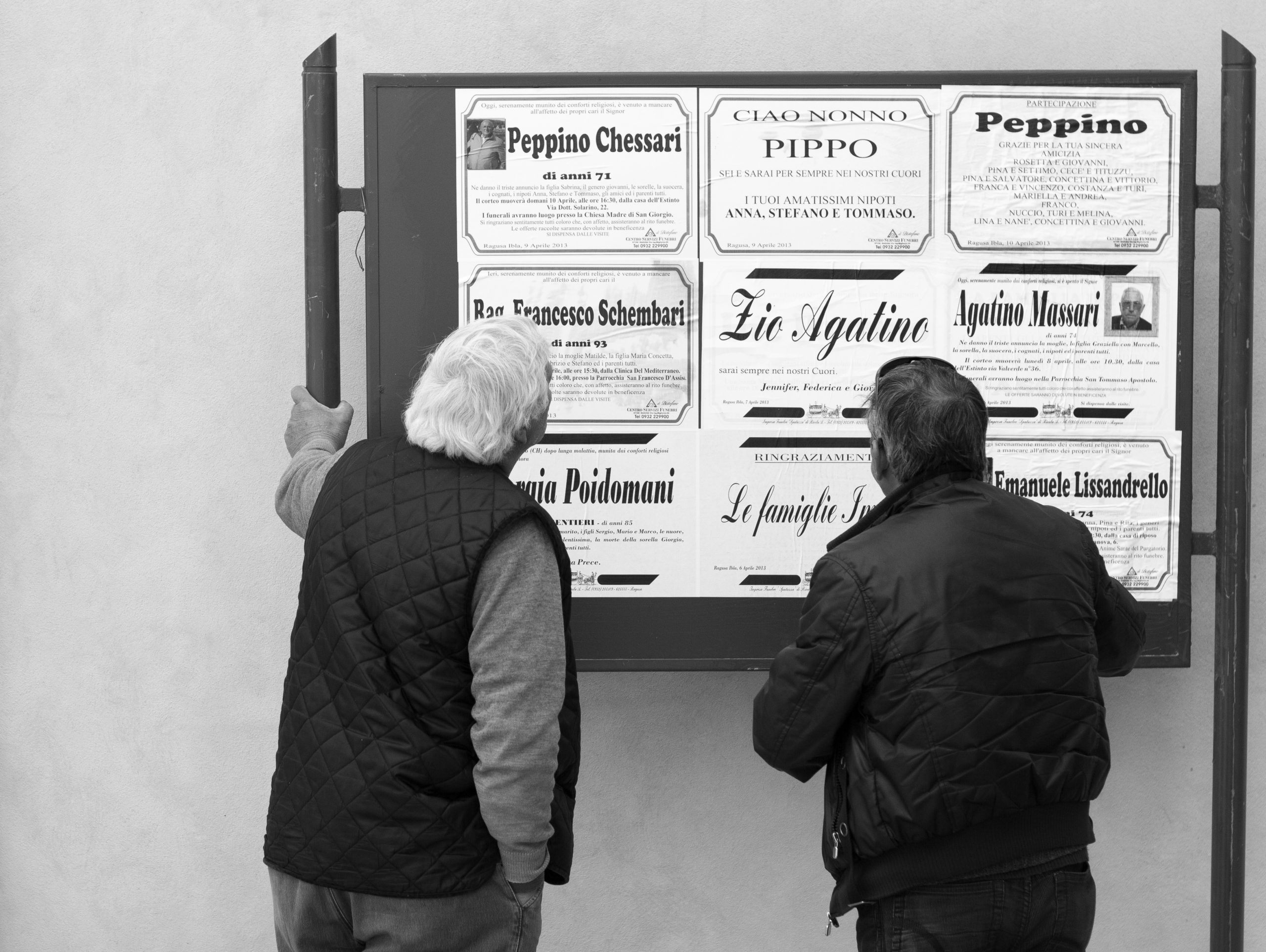

How to create an obituary

Many mourners wish to honour a deceased person appropriately. According to a long Swiss tradition, this often occurs in public obituaries, not least in newspapers.

Which NGOs and NPOs are tax-exempt?

Organisations that are tax-exempt throughout Switzerland and its cantons Not all NGOs are the same. The abbreviation for nongovernmental organisation is often simplistically equated with charitable organisations. We’ll clarify the terminology further in another article. As a general principle, the legal structure of an NGO, INGO, or NPO is irrelevant for their tax exemption: they […]

Calculating the acquired property

Matrimonial property is divided before the estate is calculated. This is indispensable for the start of the inheritance process. Calculating the acquired property results in the ‘surplus’. This is divided equally between the spouses.

Exemption from inheritance tax and gift taxes in Switzerland

Each canton has different tax rules for inheritance, legacies and gifts. You can save rather a lot of money if you know the tax exemptions and reductions. So it is worth taking a look at the regulations for your canton.

Favouring the surviving spouse

When one parent dies, the children are usually entitled to a share of the estate. However, if this is not applicable, the surviving spouse can be favoured to the maximum or granted a usufruct.

Holographic will

A holographic will is easy and cheap to draw up. One reason why it is so popular in Switzerland is because it is easy to update. It can be stored either at home or with a cantonal authority.

The notarised will

Besides handwritten and oral (emergency) wills, the law also recognises the notarised variant. This offers advantages that can mostly pay off when circumstances are complicated or an estate is valuable.

Inheritance tax in Switzerland – an overview of the cantons

In Switzerland, the cantons and municipalities can set and collect their own taxes. One of these cantonal taxes is inheritance tax. These can vary greatly from canton to canton.

CAPA – What is it and when does it intervene?

The Child and Adult Protection Authority (“CAPA”) ensures the protection of persons who are unable to take care of their needs themselves. The goal is the mildest restriction to personal freedom, which is imperative for the protection of individuals.

Death and no relatives left – who is responsible?

If the deceased person has no relatives, the municipality initially organises the funeral. However, if it turns out that the deceased person does have relatives, they will be charged with the funeral costs.

Emergency will: prerequisites and formation

An emergency will can be created in exceptional cases. It is delivered orally to two witnesses and is valid only for a limited term.

Do contracts end automatically in the event of death?

Contracts don’t just automatically end when a loved one passes away. So it is important to notify contractors and properly terminate contracts. In the event of death, there are special termination options in some cases.

Notify the bank and post office in the event of death

When a testator dies, you must report the death to all institutions and banks. The post office is also to be informed of the death. We recommend leaving a bank account open for settling the estate.

The loan agreement – what happens after death?

When we hear the word loan, we think of a bank loan. But money is also regularly lent within families or between friends. However, not many people think about what happens if the borrower dies. This could prove to be an expensive mistake.

Bequeathing a non-profit organisation – donation by will

leaving a legacy, they can give an organisation the right to a part of their estate but without giving them status as heir. Testators can also leave their free quota to non-profit organisations in a will or a contract of succession. By