What happens to internet accounts when you die?

Internet accounts are becoming an increasingly important part of our lives – but what happens to them afterwards? We will show you which precautions you can take with the ‘digital estate’ in order to handle it as smoothly as a ‘classic’ inheritance.

How testamentary capacity is assessed in people with dementia

Dementia is a disease that affects a person’s mental state. In advanced stages, those suffering from dementia may lose their capacity of judgement. This impacts the possible actions available during their lifetime and when managing their estate.

Progression of dementia

Dementia is usually a chronic disease in which the mental abilities of those affected decline over time. In order to avoid difficulties in everyday life and problems during estate planning, it is important to be well prepared.

What is dementia and how do I deal with it?

Dementia is a difficult disease to deal with, both for the patient and their relatives. Therefore, it is important to recognise the signs early on. This allows you to take effective preventative measures and plan ahead.

The death certificate – certification of death

The death certificate confirms the death of a person with all important details. It is a prerequisite for important legal steps to be taken after a death. With it, the heirs can, for example, apply for the certificate of inheritance and organise the funeral.

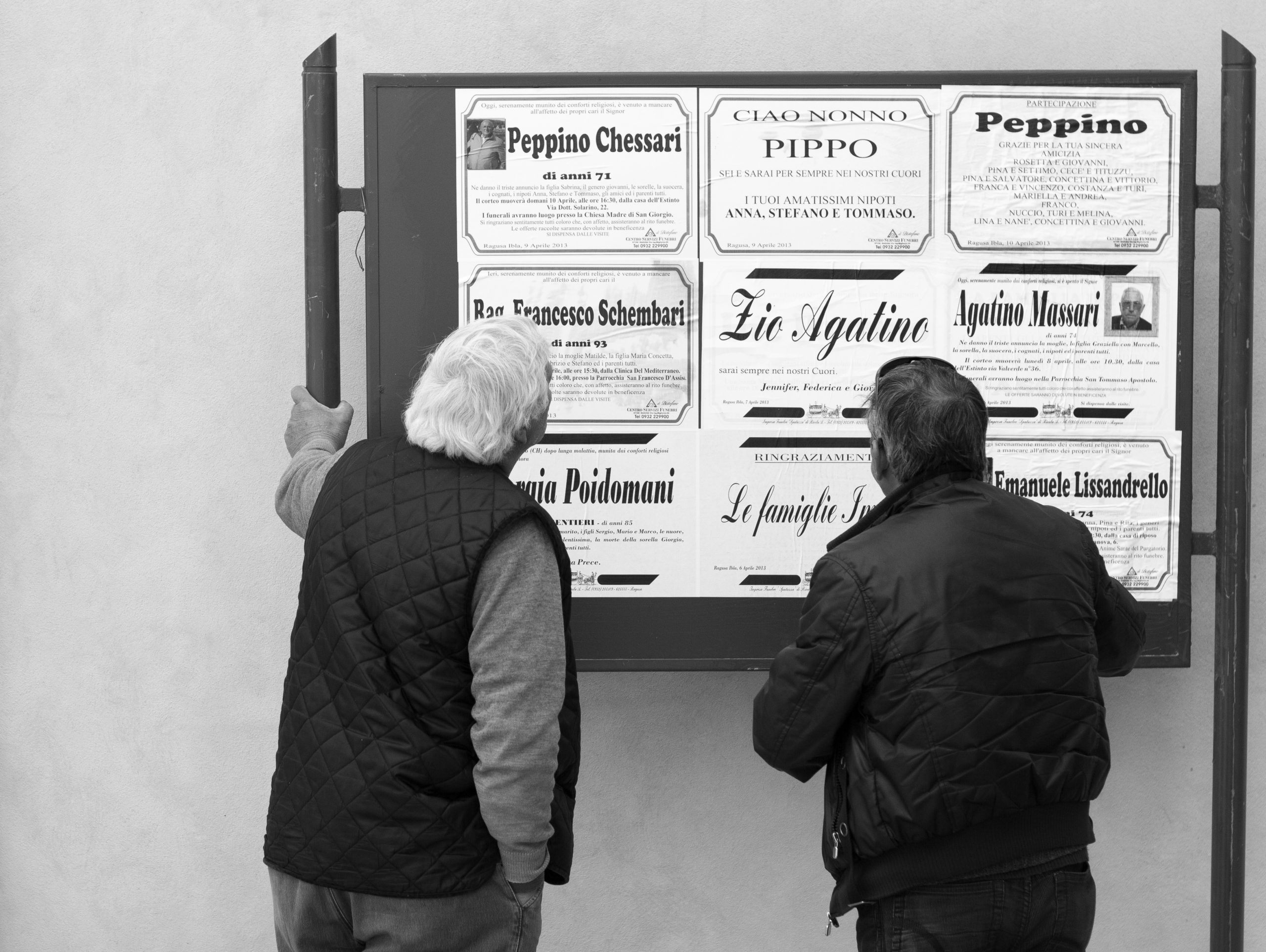

How to create an obituary

Many mourners wish to honour a deceased person appropriately. According to a long Swiss tradition, this often occurs in public obituaries, not least in newspapers.

Which NGOs and NPOs are tax-exempt?

Organisations that are tax-exempt throughout Switzerland and its cantons Not all NGOs are the same. The abbreviation for nongovernmental organisation is often simplistically equated with charitable organisations. We’ll clarify the terminology further in another article. As a general principle, the legal structure of an NGO, INGO, or NPO is irrelevant for their tax exemption: they […]

Exemption from inheritance tax and gift taxes in Switzerland

Each canton has different tax rules for inheritance, legacies and gifts. You can save rather a lot of money if you know the tax exemptions and reductions. So it is worth taking a look at the regulations for your canton.

Holographic will

A holographic will is easy and cheap to draw up. One reason why it is so popular in Switzerland is because it is easy to update. It can be stored either at home or with a cantonal authority.