When did the revised inheritance law take effect?

The revised Swiss inheritance law took effect on 1 January 2023.

What’s changing?

- Reduction of the descendants’ compulsory portions (now ½ instead of ¾ of the statutory share)

- No more protection of the parents’ compulsory portion (previously ½ of the statutory portion)

- Reduced compulsory portions mean greater leeway for testators (it will be much easier to bequeath assets to third parties, which will benefit charitable organisations)

- No more protection of the spouses’ compulsory portion in divorce proceedings (now beginning with pendency rather than on the judgment date)

- Compulsory portions for divorced spouses are cancelled when the divorce proceedings are pending (previously only when the divorce was finalised)

- More flexible regulation of company succession based on reduction of the compulsory portions

- Since 2023, the testator is may no longer reduce their assets by means of gifts or donations if all of the assets have been disposed of in an inheritance contract. The ban on making donations in the inheritance contract may be explicitly waived if all contracting parties agree.

What do I need to know as a testator?

With the new inheritance law, a higher freely disposable portion is available to you as a testator.

Example:

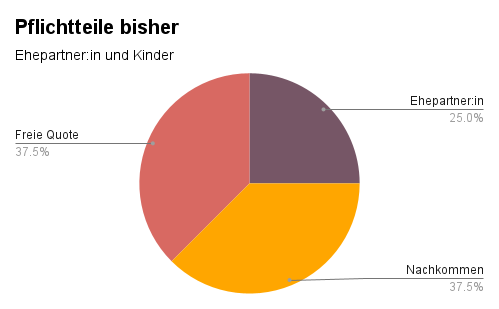

Testator Alfred is survived by his wife, Brigitte, and two children, Clara and Daniel.

Under the old compulsory portion law, his wife, Brigitte, would be entitled to ½ * ½ = ¼ of the estate.

The compulsory portions of the two children, Clara and Daniel, would have amounted to ¼ * ¾ = 3/16 each.

This means the disposable portion would have amounted to 1 – ¼ – 3/16 – 3/16 = ⅜.

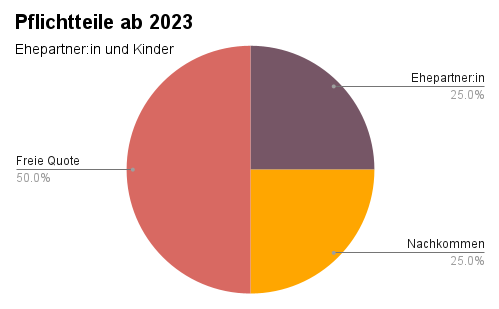

Under the revised inheritance law, the compulsory portion of his wife, Brigitte, remains the same, but those of the children, Clara and Daniel, are reduced to ¼ * ½ = ⅛.

This means the freely disposable portion increases to 1 – ¼ – ⅛ – ⅛ = ½.

Reduction of the compulsory portions

Smaller compulsory portions mean greater potential for charitable organisations. Donors who are so inclined can now leave more to charities.

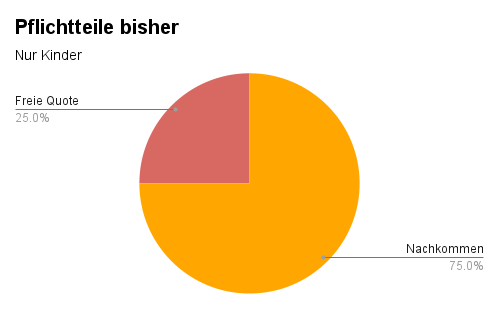

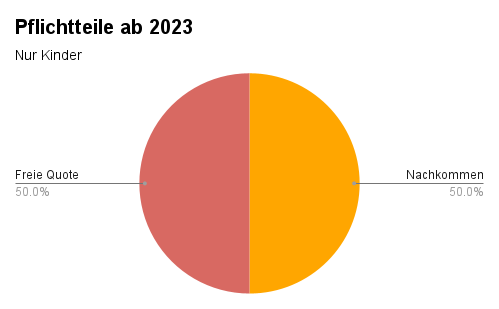

- The compulsory portion for descendants is lowered from three-quarters to half of the statutory inheritance claim.

- The compulsory portion for parents is completely done away with.

The reduced compulsory portions give testators more freedom to decide. And this means the freely disposable portion increases.

For example, testators can be more generous with domestic partners or stepchildren without a statutory inheritance claim and leave more to charitable organisations.

Do I need to create a new will?

Writing a new will is not mandatory under the revised inheritance law. In particular, if no compulsory portions of ¾ are envisaged for descendants and you do not benefit any life partner, most of it stays the same.

If you want to update your old will without a great expense, you can do this with a handwritten addition like this:

If the freely disposable portion that applied when this will was created has increased due to the new inheritance law that has taken effect in the meantime, the additional portion that has become freely disposable should be given to heir XY. The heirs protected by the compulsory portion should merely receive the newly applicable compulsory portion.

Place, Date and Signature

However, we recommend that you use this opportunity now. Review your will and have your estate planning analysed by a specialist. This makes sense, and not only due to changes in the law. It’s also possible that your familial and social relationships have changed in the meantime. Or you wish to leave more to a charitable organisation. If you have left assets to children or parents in a will, we recommend in any case to check whether the envisaged distribution of the inheritance is compatible with the modified compulsory portion.

You can create your will with the DeinAdieu will generator.

Are old wills now invalid?

Wills that were written in accordance with the old inheritance law remain valid. If you do not name any quotas in your will and have left heirs ‘the compulsory portion’, the new compulsory portions will automatically in principle apply.

How are inheritance contracts impacted by the revised inheritance law have on ?

As already mentioned with regard to existing wills, you should review your existing inheritance contracts to avoid ambiguities. This is particularly the case if circumstances indicate that the contracting parties would have agreed something different under the revised law than they did under the old law. After consultating with all contracting parties and with their consent, ambiguities can be prevented by adjusting the inheritance contract.

In addition, reference should be made to the newly introduced prohibition of gifts in inheritance contracts. If the testator has disposed of the entire estate in a contract of inheritance, she may in principle no longer voluntarily reduce her estate. This means that the assets may not be donated. The prohibition of gifts also applies to inheritance contracts concluded prior to the entry into force of the inheritance law revision on January 1, 2023. If explicitly agreed to in the inheritance contract, the testator may continue to make gifts/donations. A contract amendment is required for existing inheritance contracts, to which all contracting parties must agree.

What’s relevant for me as a fundraiser?

- The increased freely disposable portion means greater potential of the estate/legacy for charitable organisations.

- The revised inheritance law is an important anchor point of your communication. Use it to inform your donors. This mainly affects older donors.

- Check the information on your website, in your brochures and in internal documents.

- Use the opportunity to make potential donors (especially ‘pledgers’) aware that they should update their will. Especially if the will contained the ‘old’ compulsory portions. In any case, we recommend that the will be examined periodically.

You can find detailed information on the revised inheritance law in this article: https://www.deinadieu.ch/ratgeber/erbrechtsrevision-was-aendert-sich/

Expert tip

‘I generally recommend taking the opportunity to deal with your own estate planning. The long overdue revision of inheritance law gives large parts of the population the historic opportunity to profit from greater freedom in designing their own estate for the first time.’

Attorney at Law, Fabian Füllemann, Fricker Füllemann Rechtsanwälte